📊 8th Pay Commission Salary Pay Matrix Table 2026 : Expected Salary Revisions, Fitment Details & More

अगर आप central government employee या pensioner हैं और आप भी यह जानना चाहते है कि 8th Pay Commission Salary Pay Matrix क्या रहने वाली है और उसके अनुसार आपकी 8th Pay Commission Expected Salary क्या रहने वाली है तो यह article 8th Pay Commission के उन सभी anticipated updates को cover करता है, जिसमें Pay Matrix Table, Salary Increments, और structural changes शामिल हैं। लगभग 50 लाख central government workers और 65 लाख pensioners को फायदा होगा।

8th Pay Commission Salary Calculator (Central Government Employees)

8th Pay Commission Salary CalculatorThe 8th Pay Commission Salary Calculator is a helpful online tool designed to estimate the revised salary, allowances, and pension for Central Government employees and pensioners after the implementation of the 8th Pay Commission (8th CPC).

Salary Summary

8th Pay Commission क्या है?

8th Pay Commission एक महत्वपूर्ण governmental initiative है जो central government personnel के remuneration system को evaluate और modernize करने का लक्ष्य रखती है। 7th Pay Commission ने grade-based pays से level-based matrix में transition किया था, अब यह commission compensation को current economic realities और inflation trends के साथ align करने का प्रयास करेगी। सरल शब्दों में, यह salary, allowances, और pensions को update करेगी ताकि employees की purchasing power बनी रहे।

📢 Latest Updates on the 8th Pay Commission Salary Pay Matrix

8th Pay Commission Implementation Date : 8th Pay Commission का effect 1 January 2026 से expected है, जो pay revisions की typical 10-year gap के अनुसार है। Government of India ने 3 नवंबर, 2025 को वित्त मंत्रालय के एक प्रस्ताव के माध्यम से 8th Pay Commission के गठन की घोषणा की और Terms of Reference (ToR) को अधिसूचित किया, जो Finance Ministry website या Digital Sansad पर विस्तृत जानकारी के साथ उपलब्ध है। इससे 50 लाख active central employees (defense forces सहित) और 65 लाख retirees को enhanced pensions मिलेंगी। सरकार की recent advisories ने clear कर दिया है कि Dearness Allowance (DA) को basic pay में merge करने की कोई plan नहीं है, और 8th Pay Commission setup करने का कोई move नहीं हुआ। DA adjustments existing protocols के अनुसार twice a year जारी रहेंगे। कोई preparatory committee या Terms of Reference (ToR) draft नहीं हुआ। सभी forecasts – pay enhancements, DA consolidation, matrix overhauls – tentative हैं official confirmation तक।

💼 8th Pay Commission Fitment Factor

Fitment Factor 1.83 से 2.46 के बीच expected है, जो every pay matrix level पर basic pay को directly influence करेगा। Higher factor (जैसे 2.46) equitable adjustments लाएगा, contemporary fiscal dynamics को reflect करते हुए। Past commissions से compare करें: 6th CPC में 1.86, 7th में 2.57। यह factor DA merger assume करता है, लेकिन government ने deny किया है।

🧾 Formula for 8th Pay Commission Salary Calculation

You can calculate your revised gross salary using the formula below:

New Gross Salary = (Current Basic Pay × Fitment Factor) + DA + HRA

Where:

DA (Dearness Allowance) = 0 (at the time of implementation)

HRA (House Rent Allowance) depends on your city category:

X Class (Metro cities): 30%

Y Class (Tier-2 cities): 20%

Z Class (Tier-3 cities): 10%

You can follow these 8th Pay Commission Salary Calculator Examples :

Example 1: Mr. Sharma (Indian Army, Delhi)

Basic Pay: ₹1,00,000

HRA (X Class): 30% of ₹1,00,000 = ₹30,000

Fitment Factor: 2.6

Calculation:

New Gross Salary = (1,00,000 × 2.6) + 0 + 30,000 = ₹2,90,000

✅ Estimated New Salary: ₹2,90,000 per month

Example 2: Mr. Kumar (Indian Navy, Mumbai)

Basic Pay: ₹1,50,000

HRA (X Class): 30% of ₹1,50,000 = ₹45,000

Fitment Factor: 1.92

Calculation:

New Gross Salary = (1,50,000 × 1.92) + 0 + 45,000 = ₹3,74,400

✅ Estimated New Salary: ₹3,74,400 per month

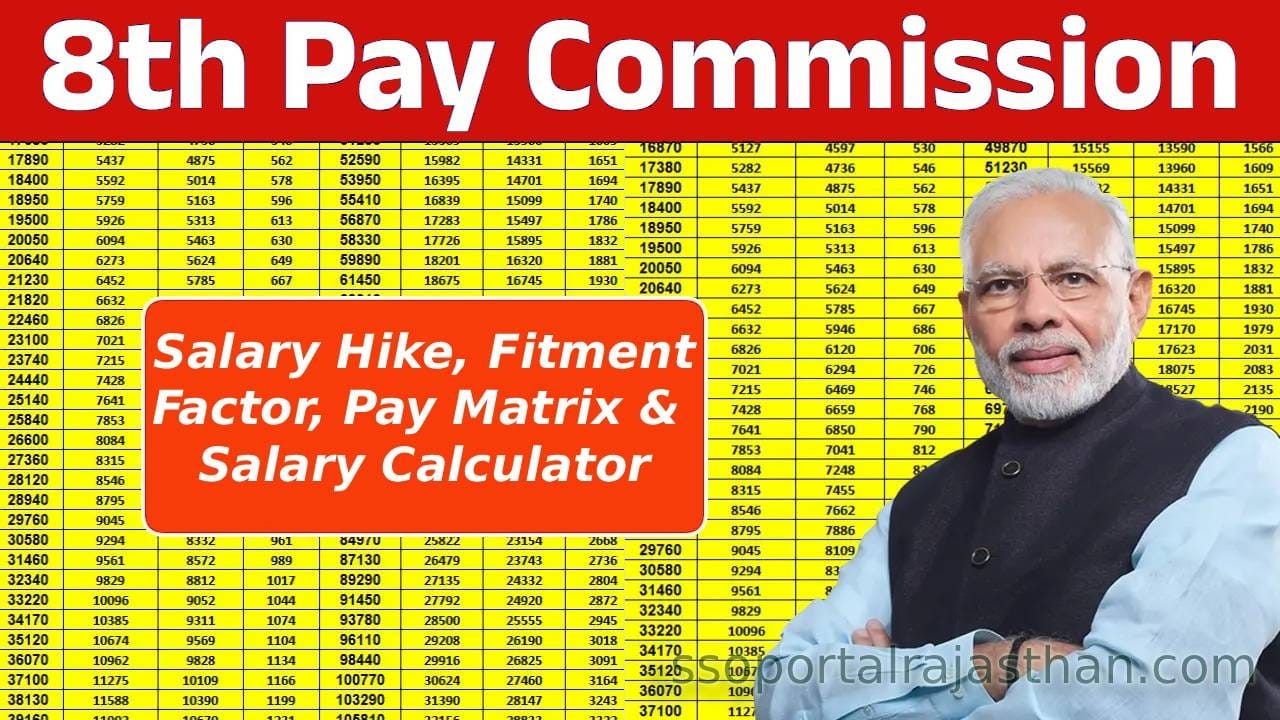

📊 8th Pay Commission Salary Pay Matrix and Hike Comparison Table

नीचे Pay Matrix Table है जो 7th CPC से 8th CPC revisions show करता है 1.83-2.46 fitment पर। यह projected है, official नहीं।

| Pay Matrix Level | 7th CPC Basic Salary | 8th CPC Basic Salary (Low End – 1.83) | 8th CPC Basic Salary (High End – 2.46) |

|---|---|---|---|

| Pay Matrix Level 1 | Rs. 18,000 | Rs. 32,940 | Rs. 44,280 |

| Pay Matrix Level 2 | Rs. 19,900 | Rs. 36,417 | Rs. 48,974 |

| Pay Matrix Level 3 | Rs. 21,700 | Rs. 39,711 | Rs. 53,466 |

| Pay Matrix Level 4 | Rs. 25,500 | Rs. 46,665 | Rs. 62,850 |

| Pay Matrix Level 5 | Rs. 29,200 | Rs. 53,416 | Rs. 71,923 |

| Pay Matrix Level 6 | Rs. 35,400 | Rs. 64,872 | Rs. 87,084 |

| Pay Matrix Level 7 | Rs. 44,900 | Rs. 82,207 | Rs. 110,554 |

| Pay Matrix Level 8 | Rs. 47,600 | Rs. 87,168 | Rs. 117,177 |

| Pay Matrix Level 9 | Rs. 53,100 | Rs. 97,059 | Rs. 130,386 |

| Pay Matrix Level 10 | Rs. 56,100 | Rs. 102,423 | Rs. 137,826 |

| Pay Matrix Level 11 | Rs. 67,700 | Rs. 123,381 | Rs. 166,452 |

| Pay Matrix Level 12 | Rs. 78,800 | Rs. 144,144 | Rs. 193,728 |

| Pay Matrix Level 13 | Rs. 1,23,100 | Rs. 225,473 | Rs. 302,226 |

| Pay Matrix Level 13A | Rs. 1,31,100 | Rs. 240,513 | Rs. 322,311 |

| Pay Matrix Level 14 | Rs. 1,44,200 | Rs. 263,886 | Rs. 354,172 |

| Pay Matrix Level 15 | Rs. 1,82,200 | Rs. 333,426 | Rs. 448,713 |

| Pay Matrix Level 16 | Rs. 2,05,400 | Rs. 375,882 | Rs. 505,584 |

| Pay Matrix Level 17 | Rs. 2,25,000 | Rs. 411,750 | Rs. 553,500 |

| Pay Matrix Level 18 | Rs. 2,50,000 | Rs. 457,500 | Rs. 615,000 |

👴 8th Pay Commission ToR Delay: Reasons

| Pay Commission | Date of Announcement | Date of Notification (Including ToR) | Delay (From Announcement to Formation) |

|---|---|---|---|

| 4th Pay Commission | 26 July 1983 | 1 September 1983 | 1 month |

| 5th Pay Commission | 1 September 1993 | 9 April 1994 | 7 months 9 days |

| 6th Pay Commission | 20 July 2006 | 5 October 2006 | 2.5 months |

| 7th Pay Commission | 25 September 2013 | 28 February 2014 | 5 months |

| 8th Pay Commission | 16 January 2025 | 3 November 2025 | 10 Months |

🧮 All the Pay Commissions Salary Comparison Table

| Pay Commission | Fitment Factor | % Of Increase | Minimum Pay |

|---|---|---|---|

| I CPC (1946-47) | – | 14.2% | Rs. 55 |

| II CPC (1957-59) | – | 20.6% | Rs. 80 |

| III CPC (1972-73) | – | 27.6% | Rs. 196 |

| IV CPC (1983-86) | – | 27.6% | Rs. 750 |

| V CPC (1994-97) | – | 31% | Rs. 2550 |

| VI CPC (2006-08) | 1.86 | 54% | Rs. 7000 |

| 7th CPC (2014-2016) | 2.57 | 14.29% | Rs. 18000 |

| 8th CPC (Anticipated Values) | 2.28 | 34.1% | Rs. 41000 |